Within this course you will learn about price formation and liquidity in securities markets. You will discover the determinants of market depth and security trading. In particular, the course focuses on price formation and liquidity in securities markets. The main issues covered are how to measure trading costs; how security prices, their liquidity and speed of price discovery are jointly determined, and how order flow affects prices; what are the determinants of market depth; how security trading is organized and regulated and how it has been reshaped by algorithmic and high frequency trading; how the organization of security trading affects trading costs and informational efficiency.

Market Microstructure

Market Microstructure

This course is part of multiple programs.

Instructor: Marco Pagano

3,256 already enrolled

Included with

Recommended experience

What you'll learn

security market; trading; market liquidity and funding liquidity

Skills you'll gain

Details to know

Add to your LinkedIn profile

21 assignments

See how employees at top companies are mastering in-demand skills

Build your subject-matter expertise

- Learn new concepts from industry experts

- Gain a foundational understanding of a subject or tool

- Develop job-relevant skills with hands-on projects

- Earn a shareable career certificate

There are 6 modules in this course

This module presents the subject of the course and its main concepts: liquidity and price discovery, and basic notions of trading in securities markets.

What's included

21 videos5 readings3 assignments

In this week you will learn that some trading costs are explicit, others implicit, and how to measure trading costs using different types of data. Furthermore, you will learn how to take the time dimension of trading into account.

What's included

22 videos7 readings6 assignments

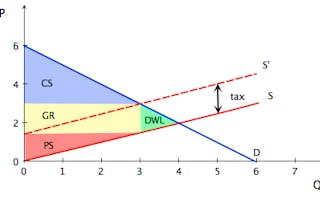

This module talks about price formation in markets with asymmetric information. You’ll understand why in these markets prices respond to the order flow and you’ll know how the informativeness of the order flow affects market liquidity and price discovery.

What's included

16 videos4 readings4 assignments

In this week we’ll talk about frictions that contribute to the bid-ask spread and generate mean reversion in prices and you’ll learn about order processing costs. Moreover, you’ll know the imperfect competition among market makers and how inventory holding costs of risk-averse dealers.

What's included

16 videos5 readings3 assignments

This week will explain how orders of different sizes have a different impact on prices and how price impact is an inverse measure of market depth. You’ll learn that depth is affected by order flow informativeness, market risk absorption capacity and competition between liquidity suppliers.

What's included

17 videos4 readings3 assignments

By the end of this week, you will learn the fundamentals of algorithmic and high-frequency trading, their impact on market quality, and explore policies to mitigate trading speed effects.

What's included

15 videos5 readings2 assignments

Earn a career certificate

Add this credential to your LinkedIn profile, resume, or CV. Share it on social media and in your performance review.

Instructor

Offered by

Explore more from Finance

Status: Free Trial

Status: Free TrialUniversità di Napoli Federico II

Status: Preview

Status: PreviewUniversity of Pennsylvania

Status: Free Trial

Status: Free TrialIllinois Tech

Status: Free Trial

Status: Free TrialIndian School of Business

Why people choose Coursera for their career

Felipe M.

Jennifer J.

Larry W.

Chaitanya A.

Open new doors with Coursera Plus

Unlimited access to 10,000+ world-class courses, hands-on projects, and job-ready certificate programs - all included in your subscription

Advance your career with an online degree

Earn a degree from world-class universities - 100% online

Join over 3,400 global companies that choose Coursera for Business

Upskill your employees to excel in the digital economy

Frequently asked questions

To access the course materials, assignments and to earn a Certificate, you will need to purchase the Certificate experience when you enroll in a course. You can try a Free Trial instead, or apply for Financial Aid. The course may offer 'Full Course, No Certificate' instead. This option lets you see all course materials, submit required assessments, and get a final grade. This also means that you will not be able to purchase a Certificate experience.

When you enroll in the course, you get access to all of the courses in the Specialization, and you earn a certificate when you complete the work. Your electronic Certificate will be added to your Accomplishments page - from there, you can print your Certificate or add it to your LinkedIn profile.

Yes. In select learning programs, you can apply for financial aid or a scholarship if you can’t afford the enrollment fee. If fin aid or scholarship is available for your learning program selection, you’ll find a link to apply on the description page.

More questions

Financial aid available,