- Browse

- Financial Modeling

Results for "financial modeling"

Status: Free TrialFree TrialI

Status: Free TrialFree TrialIIE Business School

Skills you'll gain: International Finance, Economics, International Relations, Economic Development, Global Marketing, Financial Trading, Socioeconomics, World History, Supply And Demand, Political Sciences, Trend Analysis, Risk Analysis

4.8·Rating, 4.8 out of 5 stars300 reviewsBeginner · Course · 1 - 3 Months

Status: Free TrialFree TrialU

Status: Free TrialFree TrialUUniversity of California, Irvine

Skills you'll gain: Blockchain, FinTech, Cryptography, Distributed Computing, Transaction Processing, Payment Systems, Emerging Technologies, Digital Assets, Software Systems, Computer Systems, Software Architecture, Data Integrity, Network Analysis, Peer Review

4.2·Rating, 4.2 out of 5 stars177 reviewsBeginner · Course · 1 - 4 Weeks

C

CCoursera

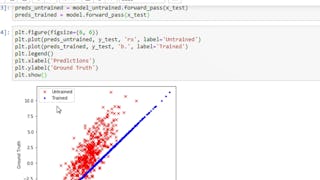

Skills you'll gain: Regression Analysis, NumPy, Supervised Learning, Machine Learning Algorithms, Machine Learning, Predictive Modeling, Deep Learning, Data Science, Python Programming

4.6·Rating, 4.6 out of 5 stars438 reviewsIntermediate · Guided Project · Less Than 2 Hours

Status: PreviewPreviewC

Status: PreviewPreviewCCase Western Reserve University

Skills you'll gain: Brand Management, Brand Marketing, Intellectual Property, Arbitration, Contract Negotiation, Client Services, Recruitment, Talent Recruitment, Insurance, Relationship Management, Financial Planning, Case Studies

4.7·Rating, 4.7 out of 5 stars155 reviewsBeginner · Course · 1 - 3 Months

Status: Free TrialFree TrialM

Status: Free TrialFree TrialMMicrosoft

Skills you'll gain: Microsoft Power Platform, Microsoft Power Automate/Flow, No-Code Development, Data Integration, Power BI, Data Modeling, Application Development, Case Studies, Business Solutions, Security Controls

4.6·Rating, 4.6 out of 5 stars174 reviewsBeginner · Course · 1 - 4 Weeks

Status: PreviewPreviewI

Status: PreviewPreviewIIndian School of Business

Skills you'll gain: Financial Statements, Financial Statement Analysis, Income Statement, Portfolio Management, Financial Accounting, Balance Sheet, Investments, Financial Modeling, Investment Management, Securities Trading, Cash Flows, Financial Market, Market Dynamics, Market Data, Return On Investment, Risk Analysis, Risk Management

3.2·Rating, 3.2 out of 5 stars13 reviewsBeginner · Course · 1 - 4 Weeks

Status: PreviewPreviewT

Status: PreviewPreviewTTecnológico de Monterrey

Skills you'll gain: Integral Calculus, Graphing, Calculus, Systems Of Measurement, Mechanics, Physics, Mathematical Modeling, Applied Mathematics, Derivatives

4.6·Rating, 4.6 out of 5 stars210 reviewsMixed · Course · 1 - 3 Months

Status: PreviewPreviewT

Status: PreviewPreviewTThe University of Edinburgh

Skills you'll gain: Empathy, Critical Thinking, Research, Diversity Awareness, Open Mindset, Emotional Intelligence, Decision Making

4.7·Rating, 4.7 out of 5 stars153 reviewsBeginner · Course · 1 - 3 Months

Status: Free TrialFree TrialR

Status: Free TrialFree TrialRRice University

Skills you'll gain: Economics, Supply And Demand, Business Economics, Market Dynamics, Economic Development, Game Theory, Financial Policy, Tax, Market Analysis, International Relations, Operating Cost, Cost Benefit Analysis, Business Metrics, Public Policies, Performance Metric, International Finance, Fiscal Management, Consumer Behaviour, Investments, Labor Relations

4.8·Rating, 4.8 out of 5 stars145 reviewsBeginner · Specialization · 3 - 6 Months

Status: PreviewPreviewT

Status: PreviewPreviewTThe Hong Kong University of Science and Technology

Skills you'll gain: International Relations, World History, Diplomacy, Oil and Gas, Political Sciences, Economics, Economic Development, Talent Acquisition, Policy Development

4.7·Rating, 4.7 out of 5 stars138 reviewsBeginner · Course · 1 - 3 Months

Status: Free TrialFree TrialL

Status: Free TrialFree TrialLLearnKartS

Skills you'll gain: Penetration Testing, Cyber Security Assessment, Threat Modeling, Human Factors (Security), Web Development, Web Servers

4.6·Rating, 4.6 out of 5 stars197 reviewsIntermediate · Course · 1 - 4 Weeks

Status: PreviewPreviewY

Status: PreviewPreviewYYonsei University

Skills you'll gain: Text Mining, Data Preprocessing, Natural Language Processing, Classification Algorithms, Data Analysis, Java, Unsupervised Learning, Machine Learning Methods, Supervised Learning

3.9·Rating, 3.9 out of 5 stars40 reviewsIntermediate · Course · 1 - 3 Months

Searches related to financial modeling

In summary, here are 10 of our most popular financial modeling courses

- Trade, Immigration and Exchange Rates in a Globalized World: IE Business School

- The Blockchain: University of California, Irvine

- Linear Regression with Python: Coursera

- Becoming a Sports Agent: Case Western Reserve University

- Introduction to Microsoft Power Platform: Microsoft

- A Beginner's Guide to Investing: Indian School of Business

- Física: Dimensión y Movimiento: Tecnológico de Monterrey

- Intellectual Humility: Practice: The University of Edinburgh

- A Story of Economics: A Principles Tale: Rice University

- Chinese Politics Part 2 – China and the World: The Hong Kong University of Science and Technology